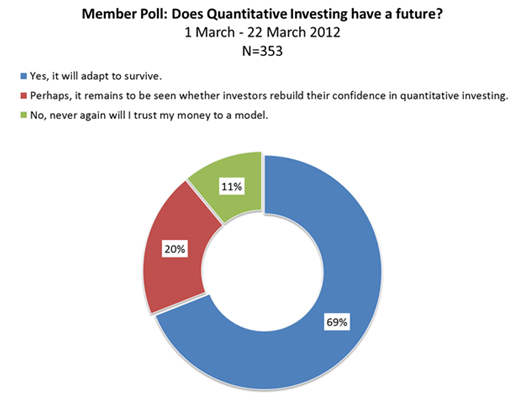

CFA Institute recently asked its members if quantitative investing has a future and, surprisingly???at least to me, nearly one-third expressed doubts.

What a difference a few years make! It wasn?t that long ago when quants were rock stars on Wall Street. Since they first arrived on the scene in force in the mid-1990s, there have been great successes, including LSV Asset Management and Renaissance Technologies, as well as the occasional and spectacular failure, like Long-Term Capital Management. By and large, though, quantitative investing enjoyed a nice run until 2007. But from the second half of that year through well into 2009, quants underperformed both traditional managers and the market indices by significant margins. Since then, according to Morningstar, relative performance has stabilized. Quants edged out their peers in 2010 and then beat them soundly in 2011.

Be that as it may, the recent CFA Institute member poll results strongly suggest that quantitative investing has a perception problem.

There are myriad hurdles for practitioners who pursue this style of investing. The headwinds facing quantitative investors were addressed in great detail in Challenges in Quantitative Equity Management, a Research Foundation of CFA Institute monograph published in 2008. Through surveys and interviews, authors Frank J. Fabozzi, CFA, Sergio M. Focardi, and Caroline Jonas sought to understand the factors that contributed to the recent period of poor performance as well as the ongoing challenges faced by quantitative managers. The monograph remains relevant today and is a quick and interesting read.

A few highlights:

Quantitative Investing?s Appeal

The authors identified three primary objectives motivating investment management firms to pursue a quantitative process: tighter risk control, more stable returns, and better overall performance. An earlier study by Casey, Quirk & Associates in 2005, titled ?The Geeks Shall Inherit the Earth?,? found that quantitative-driven processes did offer better risk-adjusted performance than did fundamental managers. Product diversification and scalability were also cited as reasons for implementing a quantitative process.

Assessing What Went Wrong

It is widely believed that the primary reason quant funds stumbled badly beginning in mid-2007 was correlation between managers, compounded by leverage. Common metrics of value and momentum, the argument goes, led quants to hold similar stocks. Then, when stocks began to sell off, many quant managers found themselves racing for the exits at the same time. Leverage employed by some players only compounded the problem. The authors confirmed this hypothesis in the monograph, quoting one manager as follows: ?Everyone in the quant industry is using the same factors. When you need to unwind, there is no one there to take the trade.??As the financial crisis unfolded in 2008 and 2009, the value bias of quant managers drew them to beaten-down financial and cyclical stocks ? the proverbial falling knife. And as the market rebounded in 2009, they were too slow to fully recover.

The improved performance of quants over the past two years may be attributable to the funds? momentum-based models adjusting to the market?s upward trend as well as less competition on both the buy and sell side, as quantitatively-managed assets have???by some estimates???been halved in recent years.

Challenges Ahead

Going forward, the authors argue, the significant challenges facing quantitative managers include correlating markets, style rotation, fundamental market shifts, and insufficient liquidity. They also point to ?too many people using similar models and the same data? as a critical issue facing the industry. Underscoring this observation, the quant managers surveyed by the monograph?s authors cited innovation, or the identification of new or unique model factors, as the most important strategy for improving performance.

Quant managers and their investors would also be well-served by reading ?The Quant Delusion: Financial Engineering in the Post-Lehman Dodd-Frank Landscape? by Stephen Blyth,?managing director and head of internal portfolio management at Harvard Management Company.?In this March 2012?CFA Institute Conference Proceedings Quarterly article, Blyth?discusses how the post-financial crisis investing landscape has been altered???and how quantitative investors must adapt to reshaping forces.?In Blyth?s view, uncertainty abounds: government interventions, including quantitative easing by the U.S. Federal Reserve and the Swiss National Bank?s efforts to weaken the franc, have distorted traditional value assessments in some fixed-income markets. Similarly, quantitative managers must assess the market impact of new and evolving regulatory reforms, including Basel III and the Dodd-Frank financial reform legislation in the United States.

So does quantitative investing have a future? The answer likely hinges on the industry?s ability to adapt and innovate.

Those themes should sound familiar to all investment managers. Fans of Fabozzi, Focardi, and Jonas, in particular, will appreciate the trio?s more recent monograph entitled?Investment Management after the Global Financial Crisis.

Business abstract illustration from Shutterstock.

war in iraq war in iraq government shutdown iraq war over iraq war over maurice jones drew megyn kelly

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.